A Few of Our Trusted Dispensary Partners

Cashless ATMs- A Smart, Secure, and Sustainable Solution for the Cannabis Industry

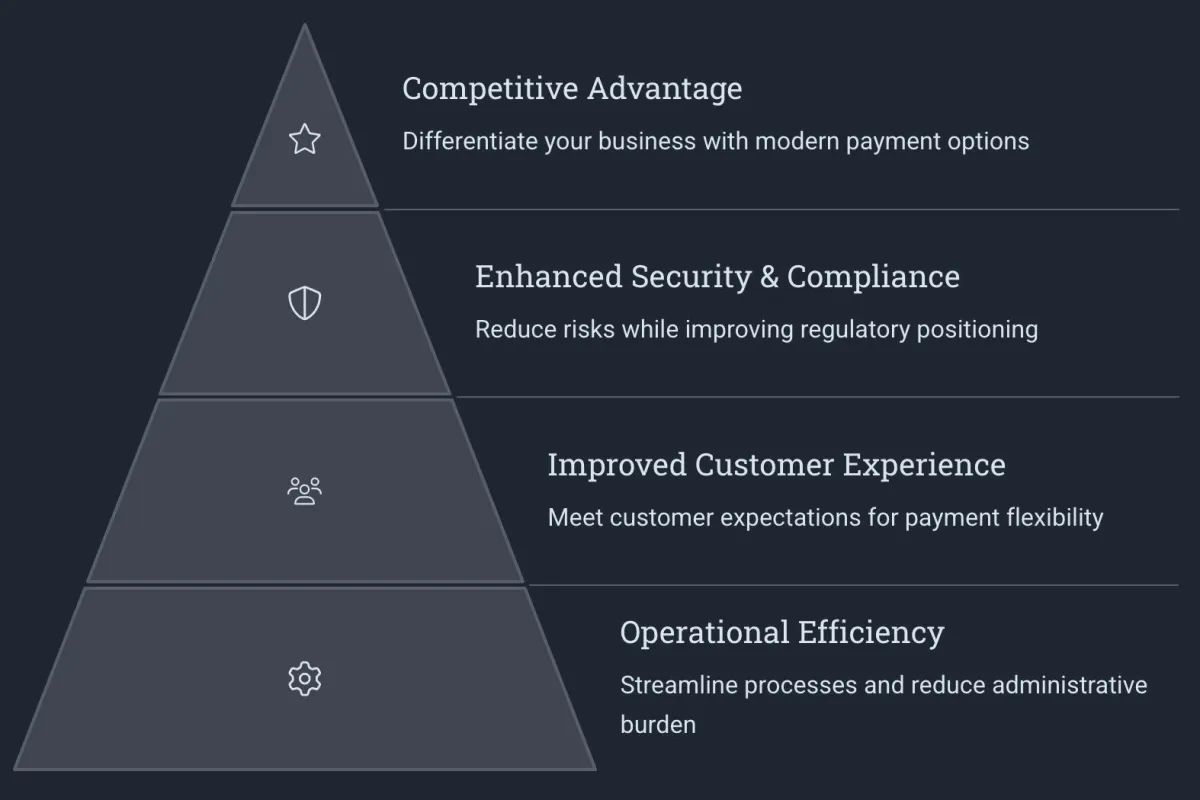

Cashless ATM solutions offer cannabis businesses a powerful combination of benefits that address the industry's most pressing financial challenges. By implementing this technology, your business can achieve meaningful improvements across multiple operational dimensions while positioning itself for long term success in an evolving regulatory landscape.

Common Misconceptions & Concerns about Cashless ATMs

Misconception: "Cashless ATMs are not compliant with federal regulations."

Cashless ATMs operate through ATM networks rather than credit card networks, utilizing a different regulatory framework. They process transactions as cash disbursements rather than direct merchant payments, which provides a compliant pathway within current banking regulations. While no payment solution in the cannabis industry is without some regulatory complexity, thousands of dispensaries nationwide successfully utilize these systems with appropriate compliance measures.

Misconception: "Implementation is complex and disruptive."

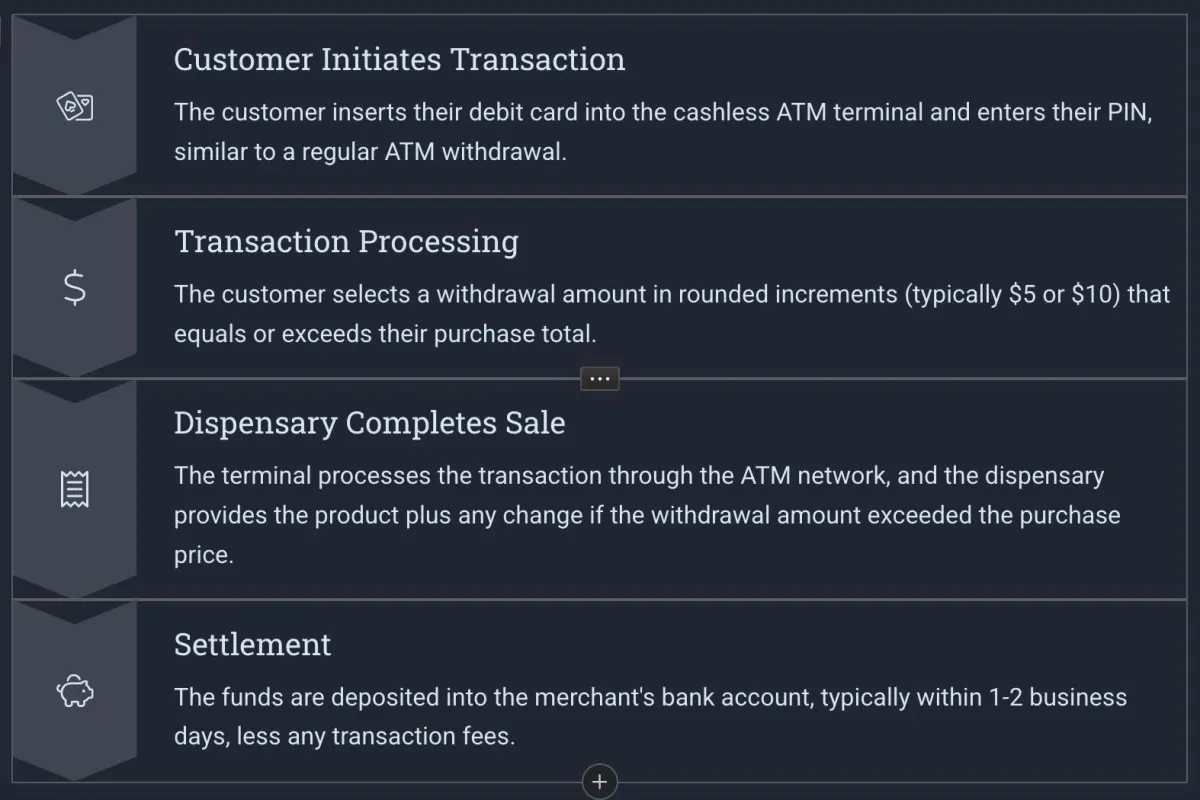

Modern Cashless ATM solutions are designed for straightforward integration with minimal disruption to your operations. Most systems can be implemented in 1-2 business days and require only basic staff training. The technology integrates with major cannabis POS systems, allowing for seamless transaction processing and reconciliation.

Implementation typically involves:

Terminal installation and testing

Staff training (usually 10-15 minutes)

POS system integration

Merchant account setup

Concern: "Transaction fees will eat into our profits."

While cashless ATMs do involve transaction fees (typically $0.50-$3.00 per transaction) these costs are offset by operational savings from reduced cash handling, decreased security expenses, and higher average transaction values. Most dispensaries find that the net financial impact is strongly positive, with increased revenues exceeding the transaction costs by a significant margin. Most dispensaries also allow customers to absorb the fee much like an ATM and get a monthly rebate per transaction.

Concern: "Customers won't understand or adopt the system."

Customer adoption of cashless ATMs is remarkably high, with dispensaries reporting 60-80% of customers choosing this payment option when available. The user experience closely resembles familiar debit card transactions, requiring minimal customer education. Simple signage and brief staff explanations are typically sufficient to achieve high adoption rates within the first month of implementation.

Concern: "System reliability and downtime."

KV Payments maintains over 99% uptime rates with multiple processing network redundancies to prevent service interruptions. Our modern systems include offline processing capabilities that allow transactions to continue even during temporary internet outages. Our providers offer 24/7 technical support to quickly resolve any issues that may arise.

The Fastest Way to Future-Proof Your Dispensary Payments

Our Point-Of-Banking system feels like a debit card withdrawal to customers, keeps you 100% compliant, and deposits directly to your account.

Why Staying Cash-Only Could

Cost You More Than You Think

Safety Concerns

Cash-intensive operations create significant security vulnerabilities. Dispensaries become targets for theft and robbery, putting employees, customers and business owners at risk. The transportation and storage of large cash amounts requires expensive security measures that eat into profit margins,

Operational Inefficiencies

Managing cash-only transactions increases operational costs through manual counting, reconciliation, and cash handling procedures. Additional staff may be required solely for cash management, and business owners often spend hours weekly handling banking- related tasks that other industries accomplish electronically.

Growth Limitations

Without access to traditional banking services, businesses struggle to obtain loans for expansions, establish business credit, process electronic payments, or efficiently manage payroll. This creates artificial ceilings on business growth and competitive disadvantages compared to other retail sectors.

These banking restrictions also complicate tax payments, financial reporting, and audit trails, making regulatory compliance more difficult to demonstrate. As the industry matures, finding viable financial solutions has become a critical priority for cannabis entrepreneurs seeking legitimacy, security, and operational efficiency.